Every company tells a story. And more often than not, it’s the lines on the balance sheet that determine how that story ends. Sometimes it’s great sales numbers; sometimes, an unexpected cash collection crisis. In today’s economy, companies survive not just based on how much they earn, but on how resilient they are to risk. Especially in an era where financial fragility is on the rise, risk management isn’t optional—it’s a survival strategy.

This applies not only to small businesses, but also to large corporations managing hundreds of customers. It's no longer just about low sales—it's about uncollected revenue. In this article, we’ll explore what financial risk management really means for businesses, the components that make it effective, and how technology can help create a more predictable system.

Anticipate Risk, Protect Cash Flow

Global economic instability, fragile supply chains, fluctuating exchange rates—protecting cash flow is now at the heart of daily operations. In both Turkey and worldwide, even a minor disruption in the cash cycle can derail a company’s growth plans.

And it’s not just small businesses anymore—larger companies now face increasingly complex financial structures. Growth, when mismanaged, doesn’t just mean higher revenue; it also brings greater exposure to risk.

“If sales are growing but collections are stalled, then growth isn’t sustainable.”

Today, companies are judged not only by their sales numbers, but by how effectively they collect payments. A business with poor cash flow won’t survive a crisis, no matter how high its revenue. That’s why financial risk management is no longer just the finance team’s job—it’s a company-wide responsibility.

Core Pillars of Risk Management

Risk Score and Credit Profile

Every customer has a different ability to pay. Being able to anticipate this is key to minimizing loss. Risk scores are customer profiles built using parameters such as payment history, debt levels, industry data, and transaction volume. With these scores, your sales team doesn’t just focus on selling more—they focus on selling to the right customers.

For businesses with large customer portfolios, automated scoring systems save time and resources. Instead of relying on manual analysis, these tools support faster and more accurate decision-making.

Accounts Receivable Cycle

The longer it takes to collect a payment, the longer you’re operating without cash. Accelerating receivables doesn’t just improve cash flow—it reduces the need for borrowing. A healthy collection cycle is also vital for keeping supply chains running smoothly. Delays in collection don’t just cause financial problems—they can damage your relationships with partners. Optimizing the collection process benefits customer satisfaction and supplier trust alike.

Modeling Customer Payment Behavior

With data-driven forecasting, you can predict when specific customers are likely to pay late. This helps you prepare. For large companies managing over a thousand clients, manual tracking isn’t just a time sink—it’s a strategic liability. Modeling also allows you to account for external factors like seasonality, promotions, or industry trends. This opens the door to proactive collection strategies tailored to real-world behavior.

Common Issues

Many companies lack any kind of risk scoring system. That means they treat all customers as equally risky—which is, let’s say, an adventurous approach.

Payment delays force companies to plug cash gaps with financing, leading to higher interest expenses.

Credit terms are often decided arbitrarily or based on industry habits, ignoring customer-specific financial conditions and intent to pay.

And these aren’t just finance department headaches—they ripple into sales, operations, even HR. Financial uncertainty is one of the biggest blockers to strategic planning.

Building Strategic Risk Management

Dynamic Scoring Systems

With systems powered by customer data, payment behavior, and market insights, you can create constantly updated risk scores. These allow for real-time risk tracking.

Dynamic models also adjust to market shifts. If risk increases across an entire sector due to economic turbulence, the system can adapt. That means you get to act before the crisis hits, not after the ship is underwater.

Term Policies Based on Risk Scores

Instead of giving every customer the same 60-day terms, you can tailor terms to risk levels. Lower-risk customers may get extended terms; higher-risk ones, shorter deadlines.

This promotes fairness—rewarding good-paying clients can boost loyalty, while also sending a message to the not-so-prompt.

Segment-Based Monitoring

Dividing customers into categories like Gold, Silver, and High Risk makes it easier to prioritize, communicate, and report. The high-risk segment can be monitored more frequently and aggressively.

Segmentation helps your team focus resources where they matter most. Collection teams can zero in on the riskiest group, while segmented reporting gives leadership deeper, more actionable insights.

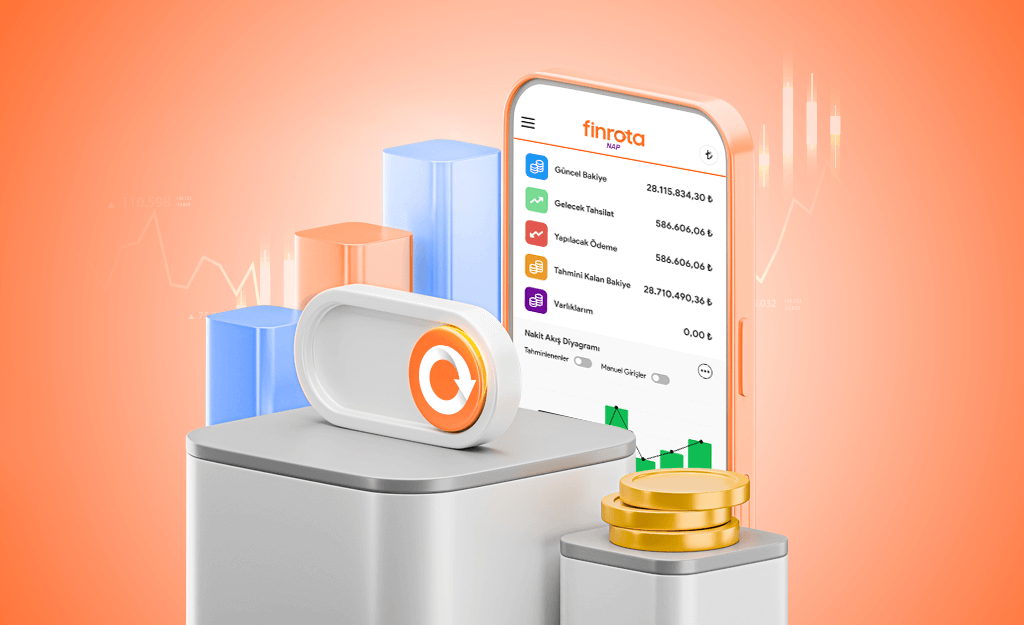

Smart Cash Flow Management with Finrota

Finrota’s NAP360 solution brings traditional financial management tools into the smart tech era. It doesn't just analyze risk—it actively helps streamline your collection process.

With NAP360, you can:

Set up transaction-level alerts and alarms

Forecast future cash flow and define credit limits and payment terms

Prioritize collections through receivables and payables tracking

“NAP360 empowers your finance team to manage cash flow effectively, avoiding wasted time and resources.”

It’s not just about building a data-driven collections model—it’s about boosting organizational efficiency. With improved departmental integration and easier reporting, your entire company builds stronger financial awareness.